I. Executive Summary

Overview: ARK Investment Management LLC (ARK Invest), in its "Big Ideas 2025" report, presents Autonomous Logistics as a pivotal area poised for transformative growth, driven by the convergence of foundational technologies like Artificial Intelligence (AI), Robotics, and Energy Storage. This sector, encompassing autonomous trucks, delivery drones, and ground robots, is envisioned to fundamentally reshape global supply chains, enhance efficiency, and dramatically reduce transportation costs. ARK positions autonomous logistics not merely as an incremental improvement but as a disruptive force set to unlock significant economic value and revolutionize industries.

Key Forecast: Central to ARK's thesis is the projection that the global autonomous delivery market could approach approximately 440 billion generated from robot and drone delivery fees and 1-2 trillion range forecasted in the Big Ideas 2023 report, potentially reflecting updated assumptions or a refined assessment of adoption timelines.

Core Drivers: The anticipated market expansion hinges on dramatic cost reductions and efficiency gains enabled by autonomy. ARK projects potential cost savings of up to 94% for application-based deliveries fulfilled by drones and a 57% reduction in truckload delivery costs per ton-mile through the use of autonomous electric trucks. These efficiencies stem from higher vehicle utilization rates, optimized routing, and the eventual removal of human labor costs from segments of the logistics chain.

Key Technologies: The report focuses on three primary segments: robotrucks, primarily for long-haul highway transport; aerial delivery drones for rapid, local delivery of small items; and ground-based robots for sidewalk or local road deliveries. These technologies are critically dependent on advancements in AI for navigation and decision-making, robotics for vehicle operation, and advanced battery technology for electrification and enabling diverse vehicle form factors.

Report Conclusion Synopsis: ARK Invest articulates a compelling, technology-forward vision for autonomous logistics with undeniable long-term potential. However, the ambitious 2030 timeline and the ~$900 billion market forecast face considerable near-to-medium-term headwinds. Significant challenges remain, particularly concerning the pace of regulatory approvals (especially for drones and trucks), the maturation and validation of autonomous technology across diverse operating conditions, the required infrastructure build-out, and achieving public acceptance. Investors and industry strategists must carefully weigh the substantial disruptive potential against these considerable execution risks and uncertain timelines.

II. Introduction: ARK Invest's Vision for Disruptive Innovation

ARK Invest & Cathie Wood: ARK Invest, founded by Cathie Wood over a decade ago, operates with a singular focus: investing in disruptive innovation. The firm's core philosophy centers on identifying large-scale, long-term investment opportunities that arise from technologically enabled breakthroughs. ARK employs an open research approach, believing this methodology enhances its ability to understand complex technological shifts and their market implications. This approach aims to capitalize on market inefficiencies where the full magnitude of innovation is often unrecognized or misunderstood by traditional investors.

The "Big Ideas" Framework: Annually, ARK publishes its "Big Ideas" report, a seminal document that serves as a guide to the breakthrough technologies the firm believes are poised to reshape the global economy. This report distills complex advancements into actionable insights across key investment themes, aiming to position investors and businesses on the "right side of transformative change". For 2025, the report identifies five core technologically enabled innovation platforms expected to drive exponential growth: Artificial Intelligence, Robotics, Energy Storage, Public Blockchains, and Multiomic Sequencing. The "Big Ideas 2025" report presents specific investment ideas stemming from these platforms.

Technological Convergence: A fundamental tenet of ARK's worldview is the concept of technological convergence. ARK posits that the most profound transformations and growth opportunities arise not from these platforms evolving in isolation, but from their complex interactions and convergences. This interplay is expected to drive exponential advances across industries, catalyze step changes in global economic growth, and potentially create macroeconomic shifts more impactful than previous industrial revolutions. Understanding this concept is crucial for interpreting ARK's specific theses, as advancements in one platform often enable or accelerate progress in others.

Positioning Autonomous Logistics: Within ARK's framework, Autonomous Logistics emerges primarily from the convergence of three core innovation platforms: Artificial Intelligence, Robotics, and Energy Storage. AI provides the necessary intelligence for navigation, perception, and operational optimization. Robotics encompasses the physical vehicles (trucks, drones, ground robots) and automation systems. Energy Storage, particularly advancements in battery technology, enables the electrification crucial for cost-effective and sustainable autonomous mobility systems. Autonomous Logistics is categorized under ARK's broader "Autonomous Technology and Robotics" investment theme.

The structure of ARK's framework suggests a direct dependency: the feasibility and timeline of their Autonomous Logistics vision are intrinsically linked to the projected advancements in these underlying foundational platforms. For instance, ARK anticipates compute performance per dollar for AI to improve over 1000x by 2030 and expects continued cost declines in advanced battery technology to enable an "explosion in form factors" for autonomous mobility. Should progress in these enabling areas lag behind ARK's expectations, the technological capabilities and economic viability underpinning the projected $900 billion autonomous logistics market might not materialize within the 2030 timeframe.

III. Deconstructing ARK's Autonomous Logistics Thesis (Big Ideas 2025)

ARK Invest's "Big Ideas 2025" report outlines a future where autonomous systems fundamentally transform the movement of goods. This section dissects the core components of their thesis for Autonomous Logistics.

A. The Promised Revolution:

Core Premise: ARK asserts that autonomous logistics systems – encompassing trucks, drones, and ground robots – are set to revolutionize supply chains. This revolution is characterized by dramatic reductions in delivery costs, significant increases in operational efficiency and convenience, and a fundamental reshaping of consumer behavior and expectations regarding delivery speed and cost. The vision extends beyond mere automation to enabling entirely new logistics models and capabilities.

Economic Impact: A key element of the thesis is the potential for "order of magnitude" cost reductions in transportation and delivery services. This cost collapse is expected to enable frictionless transport, thereby increasing the velocity of e-commerce transactions. In ARK's view, the affordability and convenience of autonomous mobility could eventually make individual car ownership the exception rather than the rule, as autonomous delivery and transport services become ubiquitous.

B. Enabling Technologies & Key Segments:

ARK identifies specific technologies and market segments as central to the autonomous logistics revolution:

Robotrucking: The primary focus here is on automating long-haul, hub-to-hub freight transportation. Autonomous trucks are expected to operate at significantly higher utilization rates compared to human-driven trucks, contributing to major cost savings. ARK estimates that autonomous electric trucks could lower truckload delivery costs per ton-mile by as much as 57%. While acknowledging that most current operations still require a human safety driver, the report notes that companies are actively working towards fully driverless operations.

Drone Delivery: ARK forecasts that drones will drastically reduce the cost of local, small-item delivery, citing a potential 94% cost reduction for app-based deliveries. However, the report also recognizes that drones face more significant regulatory hurdles to widespread commercialization compared to ground-based autonomous vehicles like robotaxis. Current paid drone deliveries are largely concentrated in rural areas outside the US, often serving critical needs like medical supply transport.

Ground-Based Delivery Robots: This category includes robots designed for local batch deliveries, operating either on sidewalks or roads. These are anticipated to be more cost-effective than human-driven delivery methods for certain use cases. ARK notes geographical differences in deployment, with sidewalk robots in the US often confined to controlled environments like college campuses, while road-based delivery robots see more common use in China.

Catalysts: The feasibility of these segments relies heavily on continued advancements in enabling technologies. Artificial Intelligence is paramount for perception, navigation, and decision-making. Declining costs and improving performance of Advanced Battery Technology are crucial for electrifying these platforms and enabling diverse vehicle designs suitable for different logistics tasks. Robust sensor suites (LiDAR, radar, cameras) are implicitly necessary for perception. Additionally, ARK mentions 3D Printing as a contributing technology that could accelerate the manufacturing process for components or even entire systems like drones, enhancing supply chain resilience.

C. Market Opportunity & Forecasts:

ARK quantifies the potential market size with specific projections for 2030:

Headline Number: The firm projects a global autonomous delivery market approaching ~$900 billion in annual revenue by 2030.

Segmentation: This total forecast is broken down into approximately 420 billion generated from autonomous trucking revenues (primarily middle-mile/long-haul).

Growth Trajectory: ARK emphasizes that this market is expected to scale from "essentially nil today," indicating an expectation of exponential growth over the remainder of the decade. This implies a rapid adoption curve driven by the anticipated cost savings and efficiency gains.

The following table summarizes ARK Invest's 2030 market forecast for Autonomous Logistics as presented in or derived from their Big Ideas 2025 materials:

Table 1: ARK Invest's 2030 Autonomous Logistics Market Forecast (Big Ideas 2025)

D. The Ecosystem According to ARK:

ARK identifies a diverse range of companies participating in the development and deployment of autonomous logistics technologies:

Key Players: The report explicitly names several companies operating within the different segments:

Trucking: Startups like Gatik, Aurora, Pony.ai, Kodiak, and Inceptio Technology (noted for accumulating significant real-world operational kilometers in China 25) are mentioned alongside established OEMs like Paccar and Volvo, and suppliers like Continental. Broader autonomy players like Waymo, Baidu, and Tesla, while often focused on passenger transport (robotaxis), possess relevant technology and data advantages.

Drone Delivery: Key players identified include Zipline, Wing (Alphabet), Meituan, Manna, FlyTrex, Matternet, and Amazon.

Robot Delivery: Companies active in this space include Starship Technologies, Neolix, Meituan, Coco, Avride, Cartken, and Serve Robotics.

Partnerships: ARK highlights the critical importance of partnerships for scaling these technologies. Autonomous trucking companies often need to collaborate with OEMs for vehicle manufacturing and integration (e.g., Aurora's partnerships with Paccar and Volvo). Similarly, drone and robot delivery providers typically need partnerships with retailers, food delivery platforms, and other logistics operators who are the ultimate customers for these services.

The ecosystem structure underscores a key dependency for many players, particularly startups. Beyond overcoming technological and regulatory hurdles, securing strategic partnerships with established industry players (OEMs, major retailers, logistics firms) is crucial for accessing markets, achieving manufacturing scale (for hardware), and validating the business model through real-world commercial operations. ARK's analysis acknowledges this necessity for collaboration within the evolving autonomous logistics landscape.

IV. Analysis and Elaboration: The Path to Autonomy

While ARK Invest paints a compelling picture of the future, the journey towards widespread autonomous logistics involves navigating complex technological, regulatory, and operational challenges. This section delves deeper into the specific paths and hurdles for each key segment, the role of enabling technologies, and a synergistic application highlighted by ARK: precision agriculture.

A. Robotrucking Deep Dive:

Current State: The primary focus for autonomous trucking remains the hub-to-hub model, concentrating on long stretches of highway driving, which presents a less complex operational design domain (ODD) compared to dense urban environments. Despite progress, the vast majority of current autonomous trucking operations still necessitate a human safety driver behind the wheel. However, the industry is pushing towards removing the driver, with several companies, such as Bot Auto, announcing plans for continuous driverless commercial freight operations and pilot programs scheduled for 2025.

Leading Companies & Data: A mix of startups and established players are vying for leadership. Inceptio Technology has gained recognition for accumulating over 200 million kilometers in commercial operations in China, significantly more than peers, providing a substantial data advantage for refining its algorithms. Companies like Aurora are notable for their strategic partnerships with OEMs (Paccar, Volvo) and suppliers (Continental). Waymo and Baidu bring experience from the robotaxi space, while Tesla leverages vast amounts of real-world driving data from its consumer fleet, although its direct application to trucking is distinct. Data accumulation is critical, with most trucking firms employing a route-by-route data collection strategy, expanding their capabilities incrementally as new routes are validated.

Regulatory Landscape: The regulatory environment for autonomous trucks in the US is fragmented and evolving. Crucially, there is no overarching federal mandate specifically governing the operation of autonomous commercial vehicles. Regulation is largely occurring at the state level, creating a complex patchwork. California, previously having banned heavy-duty autonomous truck testing, released proposed regulations in early 2025 to allow testing for vehicles over 10,001 pounds, though pushback from labor unions concerned about safety and job displacement is anticipated. Other states like Texas, Arizona, and Arkansas have been more permissive, allowing testing for some time. Legislative debates continue in multiple states (e.g., Delaware, North Dakota, Texas) regarding requirements for human safety operators, study commissions, and preemptive frameworks. The federal government, through the Department of Transportation (DOT) and NHTSA, unveiled a new Automated Vehicle (AV) Framework in April 2025 aiming to prioritize safety, remove unnecessary barriers, and move towards a single national standard, including expanding exemption programs previously limited to imported AVs. However, the timeline for concrete federal rules specific to trucks remains uncertain, influenced by industry lobbying and labor concerns.

Challenges: Beyond regulation, significant technical and operational hurdles remain. Ensuring safety and reliability across millions of miles and diverse conditions (weather, road construction) is paramount. Sensor suites must perform reliably in rain, snow, fog, and varying light levels. Cybersecurity is a major concern, protecting vehicles from malicious attacks. Achieving cost-effectiveness is challenging before the safety driver can be fully removed. Furthermore, supporting infrastructure, including potentially specialized depots for autonomous trucks and robust charging networks for electric variants, needs development.

B. Drone Delivery Deep Dive:

Current State: Drone technology itself is relatively mature regarding autonomous flight capabilities. The primary bottlenecks are logistical complexities and, most significantly, regulation. Most commercial operations today function under specific waivers or exemptions from standard aviation rules, often limiting them to less populated rural areas or specific high-value use cases like delivering medical supplies. Leading players like Zipline, Alphabet's Wing, and Amazon continue to refine their technology and operational models while navigating the regulatory landscape.

Regulatory Landscape (FAA): Progress on enabling regulations, particularly for Beyond Visual Line of Sight (BVLOS) operations, has been slow and marked by missed deadlines. The FAA Reauthorization Act of 2024 mandated a Notice of Proposed Rulemaking (NPRM) for BVLOS by September 16, 2024, and a final rule by January 2026. The NPRM deadline was missed, attributed to interagency coordination challenges. While FAA officials and the Transportation Secretary signaled intent in early 2025 to release proposed rules "in relatively short order," skepticism remains about meeting the 2026 final rule deadline, given historical timelines for complex aviation rulemaking (e.g., Remote ID took 4 years from NPRM to implementation) and potential disruptions like staffing shortages or regulatory freezes. The anticipated framework (potentially under a new Part 108) is expected to shift from approving individual flights/waivers towards certifying operators and drone types, requiring capabilities like detect-and-avoid (DAA) systems. Existing rules like Part 107 govern basic drone operations (visual line of sight, below 400 feet), while Part 135 provides a pathway for air carrier certification for package delivery, requiring rigorous safety standards.

Challenges: Achieving safe, reliable, and scalable BVLOS operations is the core challenge. This requires robust DAA technology to prevent collisions with manned aircraft and other drones. Effective Unmanned Aircraft System Traffic Management (UTM) systems are needed to deconflict airspace as drone density increases. Public acceptance remains a factor, with concerns about noise, privacy, and visual clutter. Operational challenges include weather limitations (wind, rain, icing), limited payload capacity and range, ensuring secure package drop-offs, and developing efficient ground infrastructure for launching, landing, battery swapping/charging, and package handling.

C. Local Delivery Robots Deep Dive:

Current State: Ground-based delivery robots, operating on sidewalks or roads, are currently deployed in limited ODDs. In the US, sidewalk robots are often seen on university campuses or in specific pedestrian zones, while road-based variants have seen broader application in some Chinese cities. Companies like Starship Technologies, Neolix, and Meituan are among the active players in this segment.

Regulatory Landscape: Compared to aerial drones and road-going trucks, the federal regulatory burden is lower. The primary regulatory considerations often fall to local and municipal governments, which may enact ordinances regarding sidewalk access, operating speeds, insurance requirements, and permitted zones.

Challenges: Navigating complex and dynamic pedestrian environments safely and efficiently is a major challenge for sidewalk robots. Obstacles like curbs, uneven surfaces, street furniture, and unpredictable human movement require sophisticated perception and planning. Weather resilience (rain, snow) can impact operation. Ensuring the security of the goods being transported is another consideration. For both sidewalk and road robots, relatively slow operating speeds can limit their effective range and overall delivery efficiency compared to drones or traditional vehicles. Achieving favorable unit economics and demonstrating a clear value proposition over existing delivery methods at scale remains a key hurdle.

D. Technological Convergence & Enablers:

The realization of autonomous logistics across all segments depends critically on the continued advancement and integration of several key technologies:

AI's Role: Artificial intelligence is the "brain" of autonomous systems. Its role extends beyond basic navigation to encompass sophisticated perception (interpreting data from multiple sensors simultaneously – sensor fusion), prediction (anticipating the actions of pedestrians, cyclists, and other vehicles), path planning (determining the safest and most efficient route in dynamic environments), and fleet management (optimizing assignments, routing, and charging schedules for potentially large numbers of vehicles). The development and training of these AI models require immense computational resources, driving demand for specialized AI hardware and cloud infrastructure. Vehicle-to-everything (V2X) communication, enabled by AI processing, allows vehicles to share information and perceive hazards beyond their sensor range.

Sensor Suite: Reliable perception depends on a suite of complementary sensors, typically including LiDAR (Light Detection and Ranging) for precise distance measurement and mapping, radar for detecting objects and their velocity (especially in adverse weather), cameras for visual recognition and classification, and potentially thermal cameras for detecting pedestrians and animals in low light. The challenge lies not just in the individual sensor capabilities but in sensor fusion – intelligently combining data from all sensors to create a single, accurate, and robust model of the surrounding environment, even when individual sensors are impaired by weather or lighting conditions. Cost, durability, and performance of these sensors are critical factors.

Connectivity: Continuous and reliable connectivity is essential for many aspects of autonomous logistics. High-bandwidth, low-latency communication (such as 5G, and potentially satellite communication for broader coverage 7) enables V2X communication, allows for remote monitoring and, if necessary, teleoperation of vehicles, facilitates real-time data transfer for mapping and software updates, and supports coordination through UTM systems. Ensuring robust connectivity, especially in areas with patchy coverage, is a key requirement.

Energy Storage: The shift towards electrification, driven by declining battery costs and improving energy density, is a significant enabler for autonomous logistics. Electric powertrains offer lower operating costs (fuel, maintenance) compared to internal combustion engines, reduce emissions, and provide the quiet operation often preferred for urban deliveries (especially drones and robots). Advances in battery technology are crucial for achieving the necessary range, payload capacity, and rapid charging capabilities required for commercially viable autonomous trucks and drones.

E. Synergistic Application: Precision Agriculture:

ARK Invest highlights precision agriculture as a compelling example of how AI and autonomous technology can converge to create significant value in a physical industry, offering potential parallels to the logistics sector.

ARK's View: The firm posits that the combination of AI-driven insights and autonomous farm equipment can address major challenges in agriculture, such as rising input costs, labor shortages, and plateauing yields. ARK estimates that these technologies could reduce annual agricultural operating costs by over 22% globally.

Technology: Specific examples include fully autonomous tractors (like those being developed by Deere 39), advanced sprayer technology ("See and Spray") that uses computer vision to target weeds precisely, and planting technology ("ExactShot") that optimizes seed and fertilizer placement. These leverage computer vision and machine learning to minimize waste and maximize efficiency.

Business Model Shift: ARK suggests that the adoption of these technologies could enable agricultural equipment manufacturers (like Deere, CNH Industrial 39) to transition from traditional hardware sales towards recurring revenue models, potentially resembling software-as-a-service (SaaS), based on usage or value delivered (e.g., percentage of cost savings).

Market Potential: ARK estimates a potential global serviceable market of ~$67 billion for these AI and precision agriculture tools at scale. Furthermore, they suggest that these technologies, potentially combined with advances in gene editing, could significantly boost crop yields, potentially doubling or tripling them in some cases, and dramatically increase the enterprise value of the precision agriculture sector.

The progress and adoption curve observed in precision agriculture can serve as a valuable, albeit imperfect, indicator for the broader autonomous systems landscape. While farming presents a different ODD and regulatory context than public roads or airspace, the successful deployment of autonomous vehicles and AI-driven optimization to achieve demonstrable cost savings lends credibility to the underlying technological potential that ARK envisions for the logistics sector. Demonstrating value in agriculture could bolster confidence in applying similar principles to the more complex challenges of autonomous trucking and delivery.

V. Critical Assessment: Gauging the Realism of ARK's Vision

ARK Invest's "Big Ideas 2025" presents an optimistic and technologically driven forecast for autonomous logistics. While the long-term potential is significant, a critical assessment requires scrutinizing the feasibility of the timeline, the magnitude of the forecast, and the substantial hurdles that remain.

A. Evaluating the $900B Forecast:

Feasibility Check: Achieving approximately $900 billion in global autonomous delivery revenue by 2030 represents a monumental leap from the current market state, which ARK itself describes as scaling from "essentially nil today". This forecast necessitates an exponential growth curve over the next five to six years, predicated on rapid technological maturation, swift and favorable regulatory action across multiple domains (trucking, drones), significant infrastructure investment, and widespread market adoption. Given the documented delays in areas like BVLOS drone regulations 32 and the complexities of validating Level 4/5 autonomy for trucks, achieving this scale by 2030 appears highly ambitious.

Comparison: ARK Invest is known for its bold, long-term forecasts focused on disruptive potential, often involving aggressive growth assumptions, as seen in their projections for assets like Bitcoin. While their methodology aims to capture the non-linear growth associated with technological disruption 21, the $900 billion figure for autonomous logistics by 2030 should be viewed through this lens of inherent optimism regarding the pace of change.

Implicit Dependencies: The $900 billion figure is not just a logistics forecast; it implicitly relies on ARK's optimistic projections for enabling technologies materializing on schedule. This includes the >1000x improvement in AI compute performance per dollar 1, continued rapid declines in battery costs 1, and breakthroughs in sensor technology. Furthermore, it assumes regulators globally will act decisively and favorably within the next few years to enable widespread deployment. Each of these dependencies carries significant uncertainty.

B. Navigating the Hurdles (Deep Dive):

The path to ARK's 2030 vision is obstructed by numerous significant hurdles that require realistic assessment:

Technological Maturity & Reliability: While progress is being made, achieving the level of safety and reliability required for widespread, unsupervised autonomous operation (SAE Level 4/5) remains a profound challenge. Solving "edge cases" – rare but critical scenarios encountered in real-world driving or flying – is notoriously difficult for AI systems. Ensuring the robustness and redundancy of sensor suites across all weather conditions (heavy rain, snow, fog, direct sunlight) is critical. Cybersecurity represents a persistent and evolving threat, requiring sophisticated defenses to prevent hijacking or disruption of autonomous fleets. Validating these systems to the satisfaction of regulators and the public requires billions of miles of testing and simulation, a process that is time-consuming and expensive.

Regulatory Timelines & Patchwork: Regulation remains arguably the largest bottleneck, particularly for drones and trucks operating on public infrastructure. The FAA's delays in issuing BVLOS rules for drones are well-documented, pushing timelines back significantly and creating uncertainty for the industry. For trucking, the lack of federal preemption has led to a fragmented state-by-state regulatory environment, complicating interstate commerce and deployment strategies. Political factors, including lobbying from established industries and labor unions, influence the legislative process. Potential changes in administration or regulatory priorities can further introduce delays. Achieving the necessary regulatory clarity and harmonization across jurisdictions by the mid-2020s, as implied by ARK's 2030 forecast, requires a significant acceleration of current governmental processes.

Infrastructure Requirements: Widespread deployment of autonomous logistics, especially if electrified, necessitates substantial infrastructure upgrades. This includes extensive charging networks for electric trucks and drones, potentially requiring grid upgrades. Reliable, ubiquitous high-bandwidth connectivity (5G or beyond) is needed for data transfer and potential remote oversight. Advanced traffic management systems, like UTM for drones, must be implemented and scaled. Road infrastructure might need modifications, such as dedicated lanes or improved markings, to optimize autonomous truck operation. The question of funding and coordinating these large-scale infrastructure investments remains largely unanswered.

Economic Viability & Scalability: The upfront cost of autonomous vehicles, laden with expensive sensors and computing hardware, is currently very high. While ARK focuses on long-term operational cost savings (primarily from eliminating driver wages), achieving a positive return on investment requires reaching significant scale, high asset utilization, and amortizing the initial capital expenditure. Integrating autonomous systems into existing logistics workflows presents operational challenges. Scaling from current pilot programs and limited deployments to the mass-market operations envisioned by 2030 involves overcoming significant manufacturing, operational, and maintenance hurdles. Initial driverless operations might even incur higher costs due to setup and monitoring needs.

Public Acceptance & Workforce Transition: Gaining public trust in the safety and reliability of autonomous vehicles is crucial for widespread adoption. High-profile accidents involving autonomous systems can significantly damage public perception. Concerns about job displacement for millions of truck and delivery drivers are real and politically sensitive, potentially leading to regulatory resistance or mandates for human oversight. Privacy concerns associated with delivery drones equipped with cameras, and noise pollution from drone operations in urban areas, also need to be addressed.

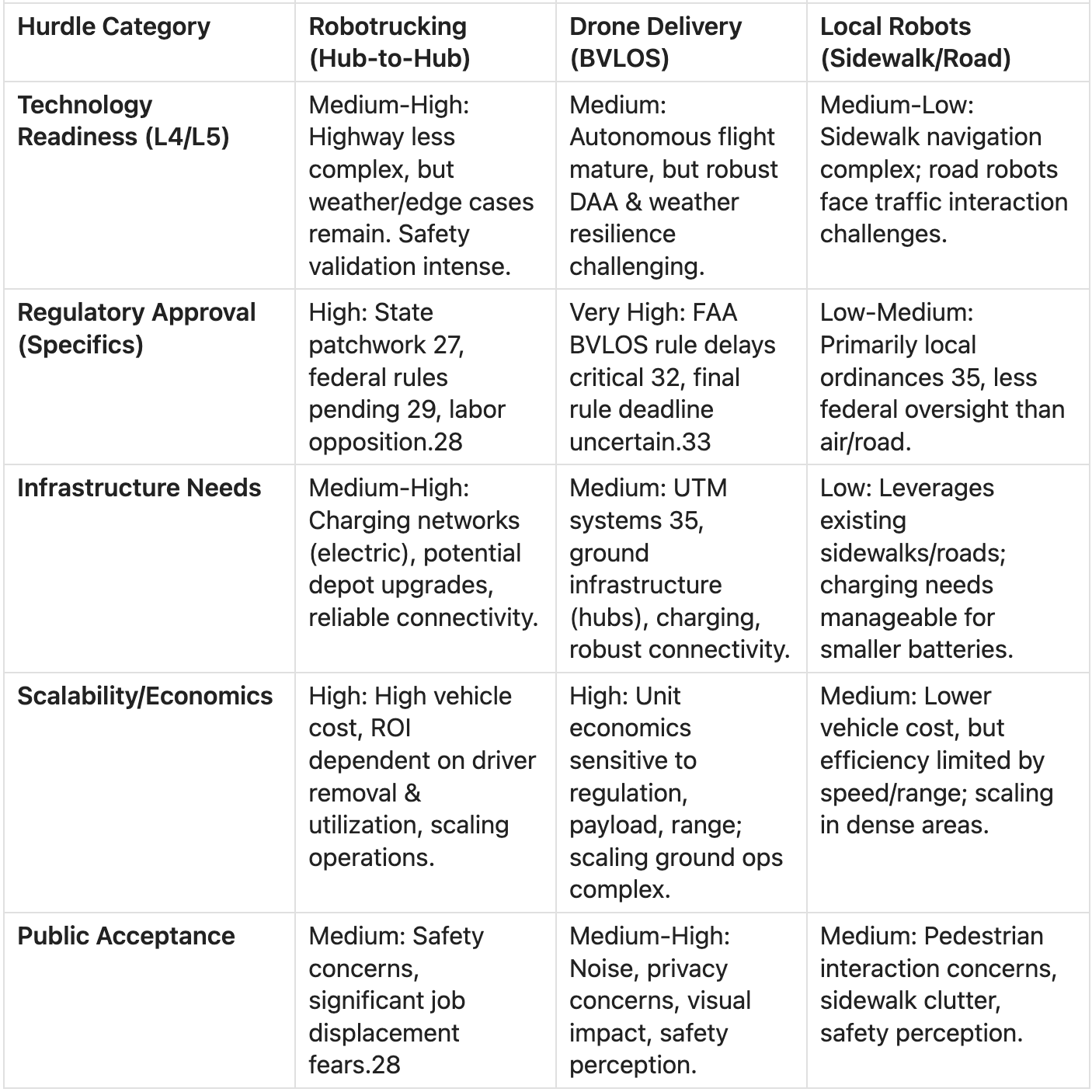

The following table provides a comparative assessment of the key hurdles across the main autonomous logistics segments, considering the 2025-2030 timeframe relevant to ARK's forecast:

Table 2: Comparative Analysis of Hurdles for Autonomous Logistics Segments (2025-2030 Outlook)

Assessment based on severity/timeline risk relative to ARK's 2030 forecast.

C. Investment Considerations & Risk Assessment:

ARK's Risk Disclosure: Investors should heed ARK's own disclosures regarding the inherent risks of investing in disruptive innovation. Forecasts are inherently limited and subject to uncertainties, and companies developing these technologies may ultimately fail to capitalize on the opportunity or be overtaken by competitors. ARK's strategies are known for their potential volatility, reflecting the high-risk, high-reward nature of their focus areas.

Balancing Bull Case with Reality: The investment thesis for autonomous logistics requires balancing ARK's compelling vision of long-term disruption and massive market potential against the substantial near-to-medium-term risks. These include technological hurdles, regulatory delays, the need for significant capital investment, and the uncertain pace of market adoption.

The primary risk associated with ARK's 2030 forecast appears to be one of timing rather than necessarily the eventual potential of the technology. The convergence of factors required—simultaneous breakthroughs in AI, sensors, batteries, coupled with rapid and favorable global regulatory action and infrastructure development—within the next five years seems exceptionally challenging. Delays in any one of these critical paths could significantly push out the timeline for achieving the scale and revenue ARK projects for 2030. This timing risk is crucial for investors whose strategies are predicated on realizing returns within that specific timeframe. Valuations based solely on ARK's optimistic 2030 scenario, without substantial discounting for these delays and uncertainties, may prove unsustainable.

VI. Strategic Outlook and Recommendations

The transformative potential of autonomous logistics, as highlighted by ARK Invest, necessitates strategic consideration by investors, incumbent industry players, and technology developers. While the path forward is fraught with challenges, the long-term trajectory towards increased automation in the movement of goods appears clear.

A. Implications for Investors:

Opportunity Landscape: The autonomous logistics ecosystem presents investment opportunities across its value chain. Key areas include:

Technology Providers: Companies developing core enabling technologies such as AI software for perception and planning, sensor hardware (LiDAR, radar, cameras), advanced battery technology, connectivity solutions (5G, satellite), and specialized semiconductor chips for AI processing.

Vehicle/Platform Developers: Pure-play companies focused on developing autonomous trucks (e.g., Aurora, Inceptio 1), delivery drones (e.g., Zipline, Wing 1), or ground delivery robots (e.g., Starship 1).

OEMs & Integrators: Established truck manufacturers (e.g., Paccar, Volvo 1) and automotive suppliers (e.g., Continental 1) that successfully integrate autonomous capabilities and potentially shift business models.

Operators/Service Providers: Future large-scale operators of autonomous fleets, which could include existing logistics giants adapting their models or entirely new service providers emerging.

Infrastructure Enablers: Firms involved in building out essential infrastructure, such as electric vehicle charging networks, 5G communication networks, and UTM platforms for drone airspace management.

Risk Mitigation: Given the uncertainties and long development cycles, diversification across different technologies (trucks, drones, robots), enabling components (sensors, AI, batteries), and potentially geographies is advisable. Investors should closely monitor key milestones as indicators of progress or delay. These include:

Regulatory: Finalization of FAA BVLOS rules 32, key state-level decisions on autonomous trucking (e.g., California 28), emergence of federal AV trucking frameworks.

Commercial: Successful demonstration of large-scale, sustained driver-out trucking operations 26, expansion of drone delivery services beyond niche applications/waivers, significant contracts between autonomous providers and major shippers/retailers.

Technological: Measurable improvements in sensor cost/performance, battery energy density/cost, AI reliability in complex scenarios, validation of safety metrics.

Partnerships: Formation of strategic alliances between tech developers, OEMs, and logistics operators.

Valuation Caution: Exercise caution regarding valuations based solely on highly optimistic, long-range forecasts like ARK's 2030 scenario. Valuations should incorporate significant risk adjustments to account for the substantial technological, regulatory, and market adoption uncertainties, as well as the potential for extended timelines. ARK's own historical volatility underscores this point.

B. Implications for Industry Players:

Logistics Providers (Incumbents): Status quo is not a viable long-term strategy. Incumbent freight carriers and third-party logistics providers (3PLs) must develop strategies to adapt to automation. This could involve partnering with technology developers, launching pilot programs to test and integrate autonomous solutions, or potentially developing in-house capabilities. Ignoring the shift risks significant disruption from more agile, tech-focused competitors. Planning for workforce transition and potential retraining programs is also essential.

Retailers/Shippers: Companies reliant on logistics for moving goods should actively evaluate the potential cost savings, speed improvements, and enhanced supply chain resilience offered by autonomous delivery. Engaging in pilot programs with autonomous trucking or drone/robot delivery providers can provide valuable insights into operational integration, cost benefits, and customer acceptance.

Technology Developers: The onus is on technology developers to rigorously demonstrate the safety, reliability, and economic viability (ROI) of their autonomous systems. Proactive engagement with regulators is crucial to help shape workable frameworks. Building strong strategic partnerships with potential customers and manufacturing partners is key for market access and scaling. Robust cybersecurity measures must be integral to system design.

OEMs (Trucks, Vehicles): Traditional vehicle manufacturers face strategic decisions regarding whether to develop autonomous systems internally, acquire technology providers, or partner deeply with autonomous tech companies. Integrating electrification and autonomous capabilities seamlessly into vehicle platforms will be critical for future competitiveness.

C. Concluding Thoughts:

ARK Invest's "Big Ideas 2025" paints a compelling, albeit highly ambitious, picture of an autonomous logistics future poised to deliver significant economic benefits through cost reduction, efficiency gains, and enhanced safety. The potential to optimize global trade and reshape consumer experiences is undeniable.

However, the path to realizing this vision by 2030, as suggested by ARK's ~$900 billion forecast, is fraught with formidable near-term challenges. The pace of regulatory approval, particularly for BVLOS drones and interstate trucking, remains a critical uncertainty. Technological hurdles related to achieving robust, all-weather, unsupervised autonomy and ensuring cybersecurity persist. Significant infrastructure investments are required, and public acceptance must be cultivated.

Therefore, a balanced perspective is warranted. While ARK's specific 2030 timeline and market size appear optimistic given the current state and trajectory of these challenges, the underlying trend towards increasing automation and intelligence within logistics operations is clear and likely irreversible. Progress will likely be uneven across different segments (trucking, drones, robots) and geographies, unfolding more gradually than the most bullish forecasts suggest. Success hinges on coordinated advancements in technology, supportive and harmonized regulation, necessary infrastructure build-out, and demonstrated economic value. For investors and industry participants, continuous monitoring of the key technological, regulatory, and commercial milestones identified in this analysis will be essential for navigating the opportunities and risks within this dynamic and transformative sector.